- Daily Chartbook

- Posts

- DC Lite #22

DC Lite #22

5 of the day's best charts and insights

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights. Upgrade to get all 30 charts.

1. Family leverage. "The US consumer remains in relatively strong shape .. [with] an expectation of 2.75% real income growth, 2-3 million more open jobs than unemployed workers, slowing debt growth, strong balance sheets, continued spending growth, and rising confidence."

2. JOLTs (I). Job openings dropped to their lowest level since 2021 while the openings-to-unemployed ratio fell to 1.3, the lowest since mid-2021.

3. Global semis inventory. Semiconductor "inventory levels remain extreme, and we could see some destocking over the coming quarters, -40% putting pressure on demand. This is likely to translate into weaker pricing and margins for the sector."

4. Short interest. Though short interest has risen sharply (see chart #22, DC#335), it remains historically low.

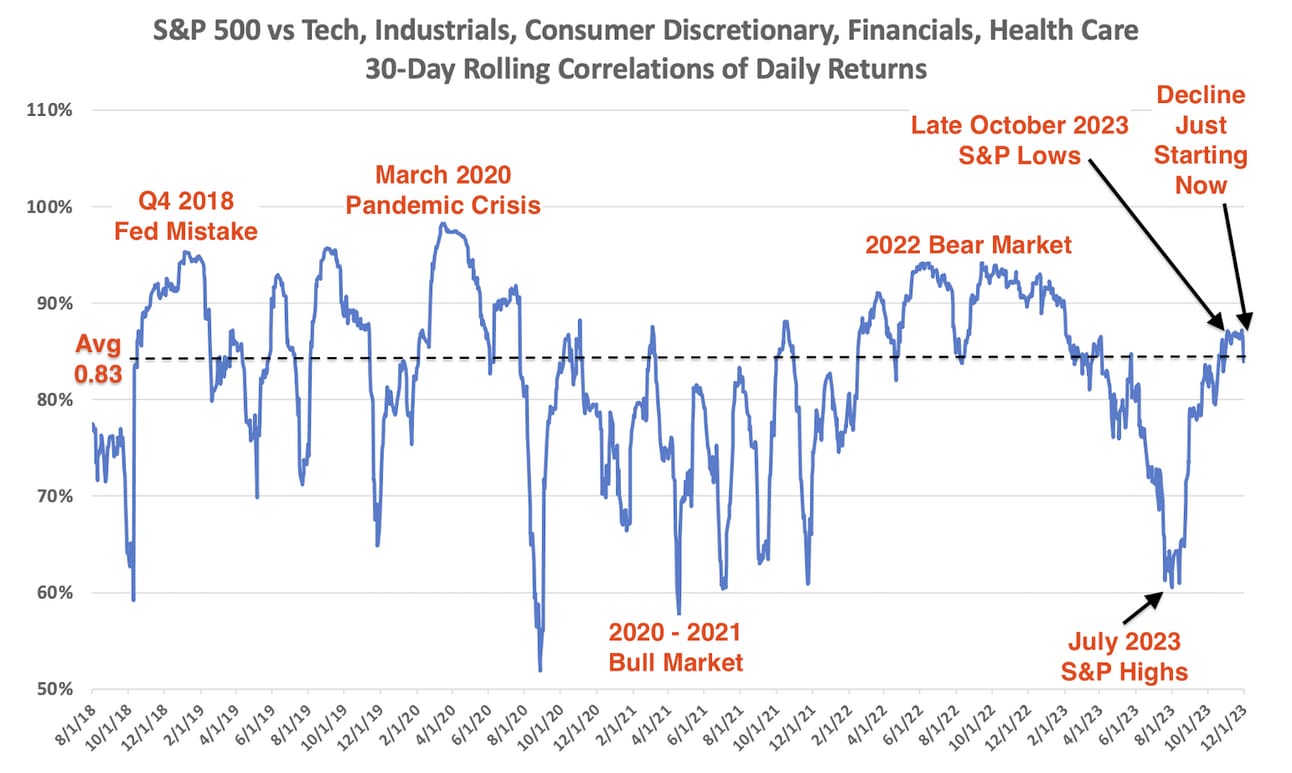

5. Sector correlations. "Even with the rally off the October lows, S&P sector correlations remain slightly above average. This implies the S&P 500 is well positioned for further gains this month."

Thanks for reading!

Reply