- Daily Chartbook

- Posts

- DC Lite #264

DC Lite #264

5 of Tuesday's best charts and insights

Welcome back to DC Lite: Daily Chartbook’s free, entry-level newsletter containing 5 of the day’s best charts & insights. Upgrade to get all 30 charts.

1. Social media sentiment. "Social media sentiment index highest since 2019."

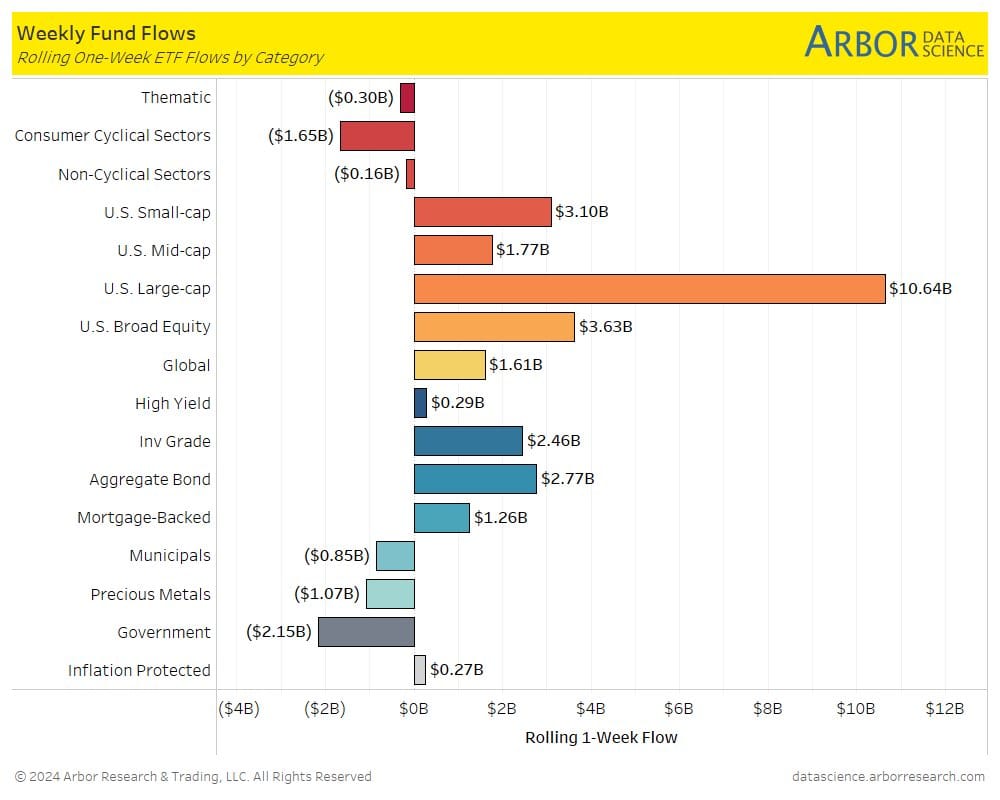

2. Weekly ETF flows. "Investors keep pouring money into U.S. large caps, which took in most (in terms of equity ETF inflows) over past week."

3. Small cap fund flows. "Flows into small cap ETFs have already surpassed the July rally and are back to the highs seen in the end of year rally last year as well ... To sustain performance in 2025, we think that small caps need to deliver on expectations for lofty growth of over 40%."

Sponsored content:

Order Foreign Currency Online. Shipped to Your Door Overnight

With a strong US dollar, you get more foreign currency for more fun! Buy currency online with CXI for the quickest and most convenient way to get currency for your international travels. Trusted with more than 1 million exchanges last year. Order currency in 3 easy steps.

4. Sector ETF flows. "Financials continued as the leader in attracting new assets, and Technology appears to be maintaining a consistent level of fund flows on a month-over-month basis. In the Energy sector, flows tend to run hot and cold."

5. Equity supply. "Big difference between now and previous risk frenzy episodes is there has been no equity supply response at all. this year is tracking to a net negative, and marks three straight years of no supply, with a rolling 3 year negative number."

Sponsored content:

Add a piece of the energy sector to your portfolio.

Access to 300 million barrels of recoverable oil reserves

Royalty-based investment model reducing operational risks

Projected 25+ years of potential royalty income

Reply